The Customer-Facing Digital Signage Market in Retail Through 2021

The Customer-Facing

Digital Signage Market

in Retail Through 2021

Realizing the future of interactivity, personalization, and dynamic content in retail stores

A 2019 Future Stores and HR Retail Report

Introduction

In 2019, a new generation of consumers has developed a preference for brick-and-mortar stores. Now, retailers are investing in smarter in-store technologies, and digital signage is at the forefront.

Digital signage allows retailers to move beyond passive content to produce positive reactions and additional value for customers. As retailers develop content for personalization and interactivity, digital signage becomes an essential part of a multichannel customer journey that connects digital and online experiences with retail brands.

Instead of advertising, marketing, or static display, digital signage has become both interactive and entertaining. For some retailers, it is already an integral part of the shopping experience.

But for others, digital signage adoption, successful content execution, and integration with physical stores present challenges that are hurting their competitive advantage.

In this report, we provide key insights into the in- store competitive environment in terms of retail strategy and maturity with digital signage. We share direct feedback from retailers themselves about their outlook for technology through 2021.

Insights from the study include:

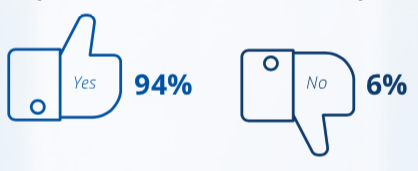

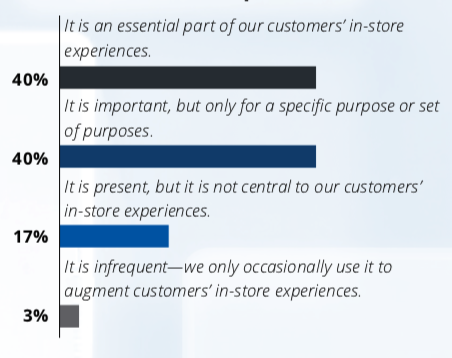

The vast majority of retailers (94%) use or have used digital signage to augment, change, or improve customers’ in-store experiences. Among them, 80% consider it either important (40%) or essential (40%) to those experiences.

Aside from helpful, enjoyable, and desirable customer experiences (45%), retailers believe differentiation from competitors (20%) is the top reason they should adopt digital signage.

Although 51% of retailers have scaled out personalized content in a cost- effective way, 33% claim they have a hard time adapting content to consumer behavior—their biggest pain point in terms of selecting the right content.

Among those who consider digital signage too expensive, 37% nonetheless consider their price limit—the point at which the cost outweighs the benefit— in the range of $25,000 per store or more.

About the Study

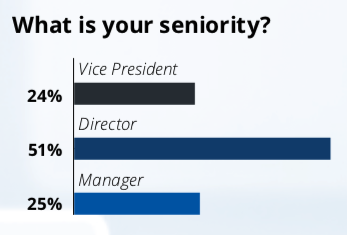

WBR Insights surveyed 100 retail leaders in charge of in-store environments. Respondents represented retailers of all sizes—those with as few as 300 stores up to 5,001 or more.

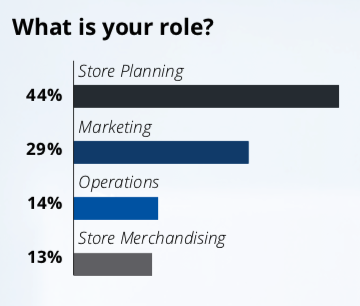

Most respondents are either store planning (44%) or marketing (29%) professionals at the vice president, director, or manager level. Over half of respondents (51%) are directors; almost one-quarter are vice presidents, and one-quarter are managers. Aside from store planning and marketing, most remaining respondents work in operations (14%) and store merchandising (13%).

Survey respondents represent retailers of all sizes. Seventy-percent of retailers in the study have either 501 – 1000 (33%) or 1,000 – 5,000 (37%) physical stores.

Fewer retailers in the study have either 300 – 500 stores (19%) or 5,001 and above (11%).

In-Store Personnel Training: One of Many Functions of In-Store Digital Signage

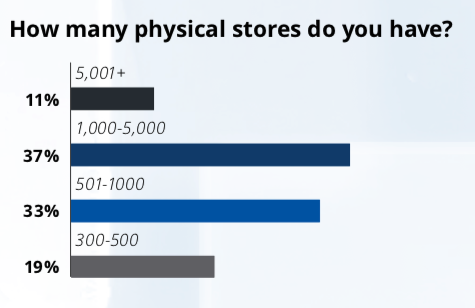

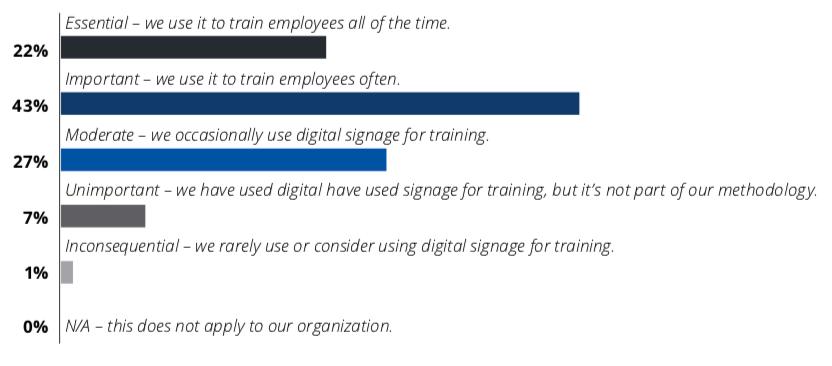

Digital signage has become common if not critical to successful in-store retail and in more capacities than one. Before their investigation into the use of customer-facing digital signage, researchers discovered most retailers consider digital signage either important (43%) or essential (22%) to in-store personnel training and use it frequently.

The focus of this survey is on customer-facing digital signage. However, please let us know how important you think digital signage is to in-store personnel training.

Digital Signage and Customer Experiences

With new digital technologies, retailers are discovering new layers of value in indirect communication. Digital signage is becoming a standard for in-store marketing, education, and engagement. But building a successful digital signage strategy calls for new types of content and interactive experiences for customers.

Digital signage not only plays an important role in training personnel. Nearly all in-store retailers (94%) use or have used digital signage to augment, change, or improve customers’ in-store experiences.

Among those retailers, 80% consider it either important (40%) or essential (40%) to customer experiences. This means the vast majority

of in-store retailers who have used digital signage to improve customer experiences also consider it critical to in-store experiences in at least one capacity.

Digital signage gives retailers the ability to manage content in real-time—as retailers graduate from passive displays to interactive experiences, they have more opportunities to optimize content for customers.

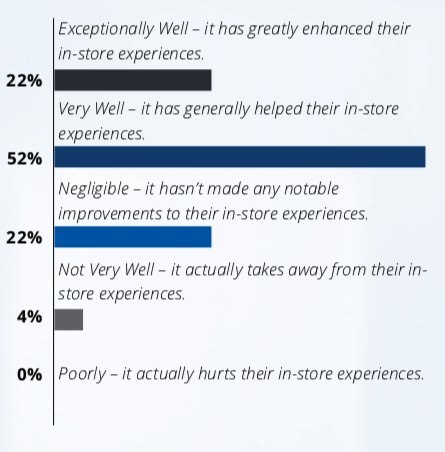

Retailers claim customers are already reacting and responding positively towards digital signage. Over half of retailers (52%) claim customers respond to their use of digital signage very well—it has generally helped their in-store experiences—and 22% claim customers have responded exceptionally well. But despite this majority, over one-quarter of respondents claim customers’ responses are negligible (22%), with no notable improvements to their in-store experiences; or that digital signage actually takes away from those experiences (4%).

More retailers claim their signage has a negligible or negative effect on customers than do those only modestly invested in digital signage, meaning some or even many retailers who consider their investment critical to customer experiences are failing to deliver on customers’ expectations. As we will and, digital 4% signage success hinges on more than just scope of adoption—function, content, placement, and competitive value all contribute to the success of retailers’ investment.

Do you use, or have you used, any type of digital signage to augment, change, or improve customers’ in-store experiences?

Since you said yes, how would you rate digital signage as a factor of your customers’ in-store experiences?

Since you said yes, how have your customers responded to your use of digital signage, regardless of its frequency?

Digital Signage Pain Points

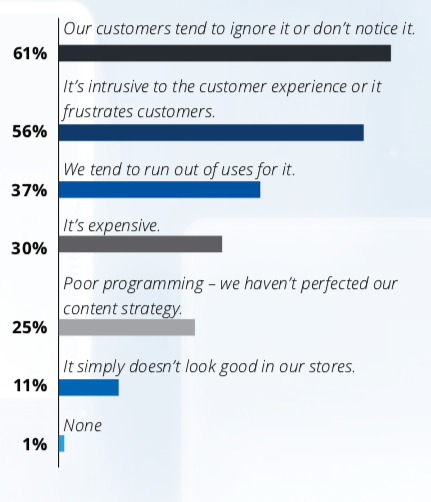

When asked to identify their biggest pain points for customer-facing digital signage, some of the most widely select options were logistical— cost, frequency of use, and how to position the displays inside stores. But many other pain points are directly related to content, indicating both personalization and placement are equally strong contributing factors to customer experiences.

In-store retailers’ most cited pain point for customer-facing digital signage is the tendency of their customers to ignore it or fail to notice it (61%). Contrarily, 56% of retailers claim digital signage can be intrusive to the customer experience and actually frustrate customers. This indicates some retailers have struggled with both issues, each of which may be grounded in their choice of content or the positioning of their signage. Another 11% of retailers feel digital signage simply doesn’t look good in their stores.

The third major issue, for over one-third of retailers (37%), is that they run out of uses for their in-store digital signage. This makes it more diffcult for retailers to justify their digital signage investment. Similarly, programming remains a problem for 25% of retailers who claim they have not perfected their content strategy. Only 1% claim they have no pain points associated with customer-facing digital signage in their stores.

The overarching issue retailers have with their signage is diffculty improving the customer experience—whether signage is poorly positioned, doesn’t provide the right content, or isn’t in operation altogether.

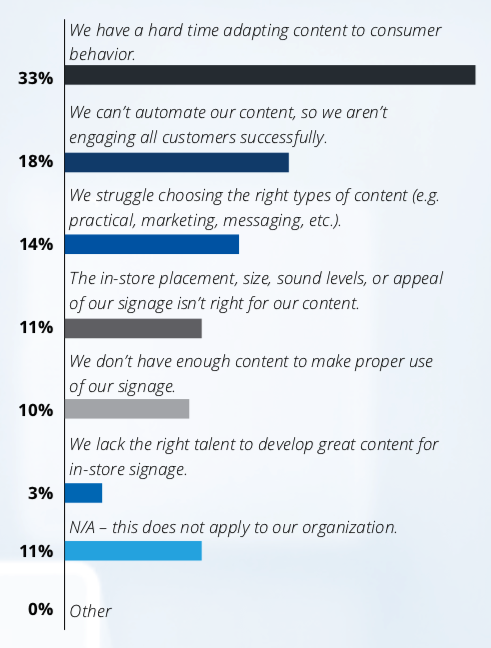

In fact, when asked to select one major pain point in terms of selecting the right content, about one-third of retailers (33%)—a plurality— claim adapting content to consumer behavior is their biggest. Similarly, 14% struggle to choose the right types of content, meaning almost half of retailers’ top struggles are related to content specialization. The second-most cited pain point, content automation, also highlights issues with engaging customers on their terms. Some retailers simply lack the content (10%), or they lack the talent they need to develop the right content altogether (3%)

In-store placement, size, and sound levels, as well as the appeal of signage itself, is a problem for 11% of retailers. The lack of content to make proper use of signage may contribute to the over one-third of retailers that simply run out of uses for their digital signage.

Managing the cost of digital signage

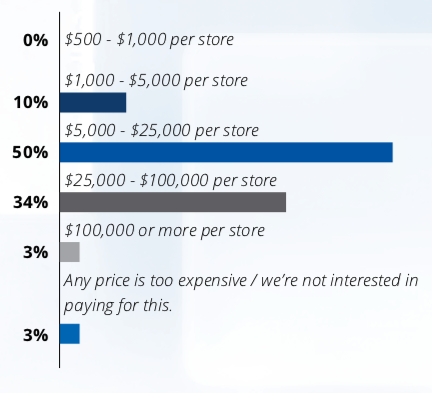

One potential contributor to logistical issues is the affordability of digital signage, and whether or not retailers are getting the value they need from their existing investments. But among only the 30% of retailers who consider digital signage too expensive, most place a reasonably high threshold on how much they are willing to pay.

Within this group of respondents, 37% consider their price limit—the point at which the cost outweighs the bene t—in the range of $25,000 per store or more. Fifty percent of this segment rates as low as $5,000 as their price limit, while 10% rate as low as $1,000. No respondents in this segment rate any amount under $1,000 as an amount at which the price outweighs the bene t.

To reiterate, 19% of respondents have only 300 – 500 stores. They may struggle to and digital signage solutions within their budgets that nonetheless deliver on their customer experience objectives. But as signage solutions evolve to rely less on hardware and more on digital flexibility, adaptability, and personalization, next-gene digital signage solutions are becoming more accessible to all retailers.

Digital Signage Adoption and Success

Digital signage can provide a lot of value for retailers. But winning strategies require a variety of considerations, including curated content; in-store placement; technology investments; and striking a balance between marketing, support, and entertainment. The data shows that larger retail players have already started a digital revolution in their stores, raising the stakes for would-be competitors. “SME retailers like us will also have to pick up pace and achieve the same level of competence to stay competitive,” says one respondent.

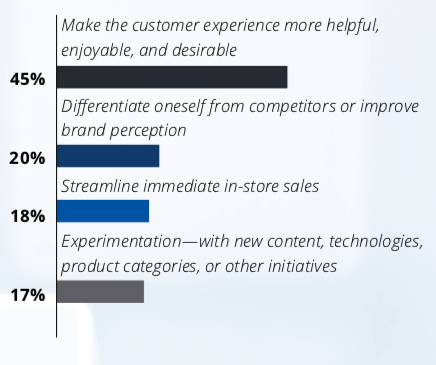

Aside from helpful, enjoyable, and desirable customer experiences (45%), retailers believe differentiation from competitors (20%) is the top reason they should adopt digital signage.

Other retailers consider streamlining immediate in-store sales (18%) the top reason for adopting in-store digital signage, while 17% consider experimentation—with new content, technologies, product categories, or other initiatives—the top reason, both of which are more direct line-of- business drivers for in-store sales.

Generally, retailers are highly optimistic about the potential success of several applications

of digital signage as they contribute to these objectives. This includes sales content like offers, promotions, and advertising, but also value-added features like personalized content, entertainment, and trivia.

“It’s going to be important for retailers to match the digital signage with the aesthetics of the store. Its all about creating a first impression that lasts longer and keeps the customers returning for the same experience.“

Director, Marketing

What are your biggest pain points for customer-facing digital signage adoption in your stores?

What are your biggest pain points in terms of selecting the right content for customer-facing digital signage?

Since you said it’s expensive, at what price range do you think the cost outweighs the bene t?

Which of the following do you think is the top reason a retailer should adopt in- store digital signage, despite whether or not you use it?

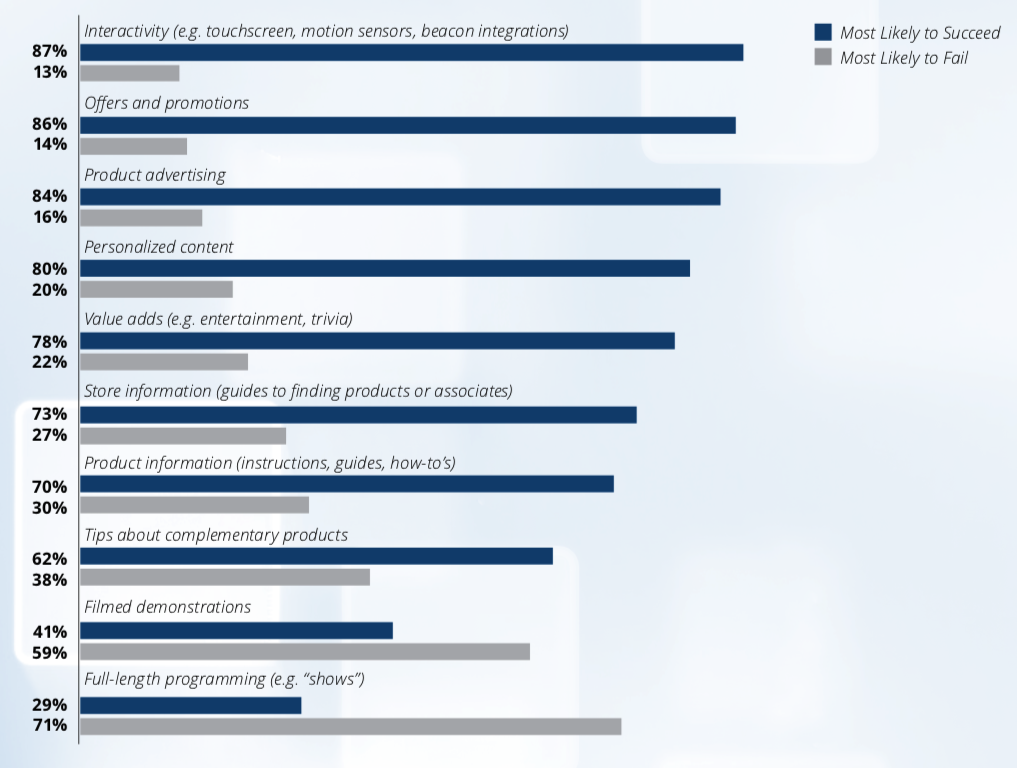

Retailers also prioritize customer engagement via interactivity. As one respondent observes, retailers can use digital signage to promote one- to-one assistance to customers in busy stores. Some digital signage enables retailers to collect in-store data, allowing them to quickly adapt content to customers and improve experiences.

In fact, retailers consider interactivity (87%) most likely to succeed as part of a digital signage strategy. Over 75% of respondents agree that sales-driven content initiatives like offers and promotions, product advertising, personalized content, and value adds are also most likely to succeed, in each case.

While majorities, fewer retailers believe instructive, educational, or information-based content are most likely to succeed. Thirty percent of respondents believe product information—such as instructions, guides, and how-to’s—are most likely to fail; 38% feel the same way about tips for complementary products.

According to most retailers, long-form content

is the digital signage content type most likely to fail. Fifty-nine percent feel this way about filmed demonstrations, and 71% feel this way about full- length programming (i.e. “shows”).

Digital signage has a wide range of applications, most of which have great potential for success. Retailers interested in their next great in-store customer experience and marketing investment are looking to digital signage to deliver on their engagement objectives. But choosing a strategy could make or break the success of those investments, and evolving technologies add new pathways to future in-store success.

Which of the following features do you think are most likely to succeed as part a digital signage strategy, and which features are most likely to fail?

Digital Signage Innovations for 2021

Retail professionals were asked to picture their companies’ in-store customer experiences in 2021 and describe how digital signage ts into the picture:

“We will use in-store digital signage as a message-bearing strategy and also use it as a communication and data collection platform.”

Manager, Store Merchandising

“Retail has become more demanding in terms of customer expectations and that’s where digital signage ts in perfectly. We are including it in our core strategies and will be able to capitalize on the bene ts.”

Vice President, Marketing

“Digital signage will be scaled up and integrated with AI and new technologies to create meaningful campaigns by 2021.”

Director, Store Planning

“By 2021, we will have a digital way anding system within our stores to [help] customers to locate the exact product that they want. This will also include offers and promotions and hold cross-selling capabilities.”

Manager, Store Planning

“We will look towards bringing digital screens that can also act as personal assistants while a customer is shopping. This assistant will give advice and suggest the best look or products through the efforts of integrated AI.”

Manager, Store Planning

“We will use digital signage with sensors that generate data on multiple fronts; and this data, if possible, will be processed in real time to promote an AI-driven content display.”

Vice President, Marketing

Scaling out digital signage: falling short with personalized content and interactivity

In most cases, retailers have already successfully scaled out content types they deem most likely to succeed. But while the vast majority of retailers deem interactivity and personalized content most likely to succeed, approximately half are yet to scale these out effectively.

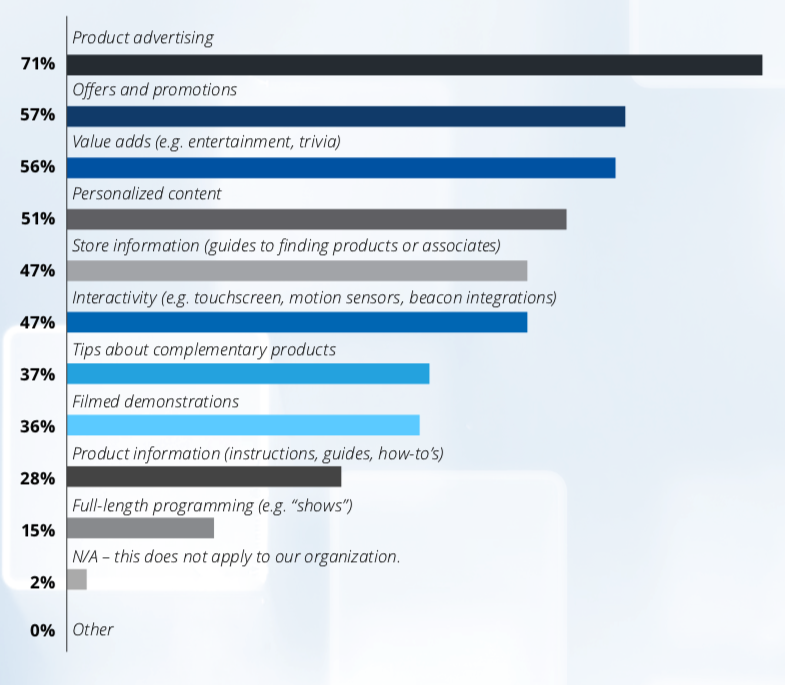

Just as the vast majority of retailers are optimistic about the success of product advertising with digital signage, 71% have already scaled this out in a cost- effective way. Similarly, 57% have scaled out offers and promotions, and 56% have scaled out value adds, each of which the majority of retailers consider the most likely to succeed.

Which types of customer-facing digital signage have you ALREADY scaled out in a cost-effective way?

Just over half of retailers (51%) have scaled out personalized content in a cost-effective way—29% fewer retailers than those who deem personalized content most likely to succeed. As we will and, 33% claim they also have a hard time adapting content to consumer behavior—their biggest pain point in terms of selecting the right content.

Similarly, only 47% of retailers have scaled out interactivity for digital signage—touchscreens, motion sensors, and beacons integrations, for example—in a cost-effective way. Most retailers believe interactivity is the most likely content type to succeed, indicating retailers have high ambitions for future investments in this area. As one retailer acknowledges, interactive digital tools have become a ‘lifestyle norm’ for customers; adopting digital interfaces that come with interactive gesture recognition and arti cial intelligence is a priority, in their case.

Nearly half of retailers (47%) have successfully scaled out store information (e.g. guides to anding products or associates). Fewer retailers have scaled out tips about complementary products (37%), filmed demonstrations (36%), and product information (28%), all of which fewer retailers consider likely to succeed versus most other content types.

For most retailers, meeting their 2021 goals means creating a more individualized experience for customers through digital signage. Their content must become more responsive, processing data at the source to provide better future orientation. But unlike most digital interfaces, technology and content are not the only factors retailers must consider when scaling out digital signage.

Conclusion

Digital signage can complement the in-store customer journey, making it more seamless and adding value to customer experiences beyond the original intent to purchase. Now, even growing retailers can access next-gen technologies to entice customers, entertain them, and add value to how they search for and select products. But as with all new investments, retailers of all sizes need a robust content and delivery strategy to create more engaging, loyalty-generating, and pro t-driving experiences in their physical stores.

About the Authors

With the Hughes MediaSignage platform, distributed retailers can manage 1000s of digital signs and SmartTVs from a single, cloud-based content management system from anywhere at any time. In real time, you can see signage status, push dynamic and planned updates to any number of players– to ensure your message hits the right audience at the right time. With thousands of both customer and employee-facing screens deployed today, Hughes has the solutions you need to deliver better, more immersive, and more effective customer & employee experiences.

To learn more, visit: http://business.hughes.com/signage

HR Retail brings together retail and ecommerce HR innovators to push forward workforce efforts that keep apace with the rapid transformations in the retail industry. While working with our retail audience from our eTail and Future Stores series, we realized the need for retail HR professionals to come together to revitalize recruitment, employee engagement, and development.

To learn more, visit: https://hrretail.wbresearch.com

Building upon Worldwide Business Research’s (WBR) vast expertise in creating educational executive events for the Retail Sector including eTail, Mobile Shopping and Next Gen Customer Experience, the Future Stores Event was launched in 2013 and continues to be the leading instore experience event. Months of industry research with over 100 retail executives is compiled to create the program each year.

To learn more, visit: https://futurestores.wbresearch.com

WBR Insights is the custom research division of WBR (Worldwide Business Research), the world leader in B2B focused conferences. From research-based whitepapers to benchmarking reports, infographics and webinars, our mission is to help global institutions across a variety of industries to inform and educate their key stakeholders while achieving their strategic goals.

To learn more, visit: digital.wbresearch.com